Case Study - Disrupting fintech remittances with user‑centered product design

Early‑stage product leadership and UX for a fintech money transfer app that significantly increased conversion and brought Azimo’s cross‑border payments to market.

- Client

- Azimo

- Year

- Service

- Fintech Product Design, UX, Conversion Optimization, Front‑end Development

Overview

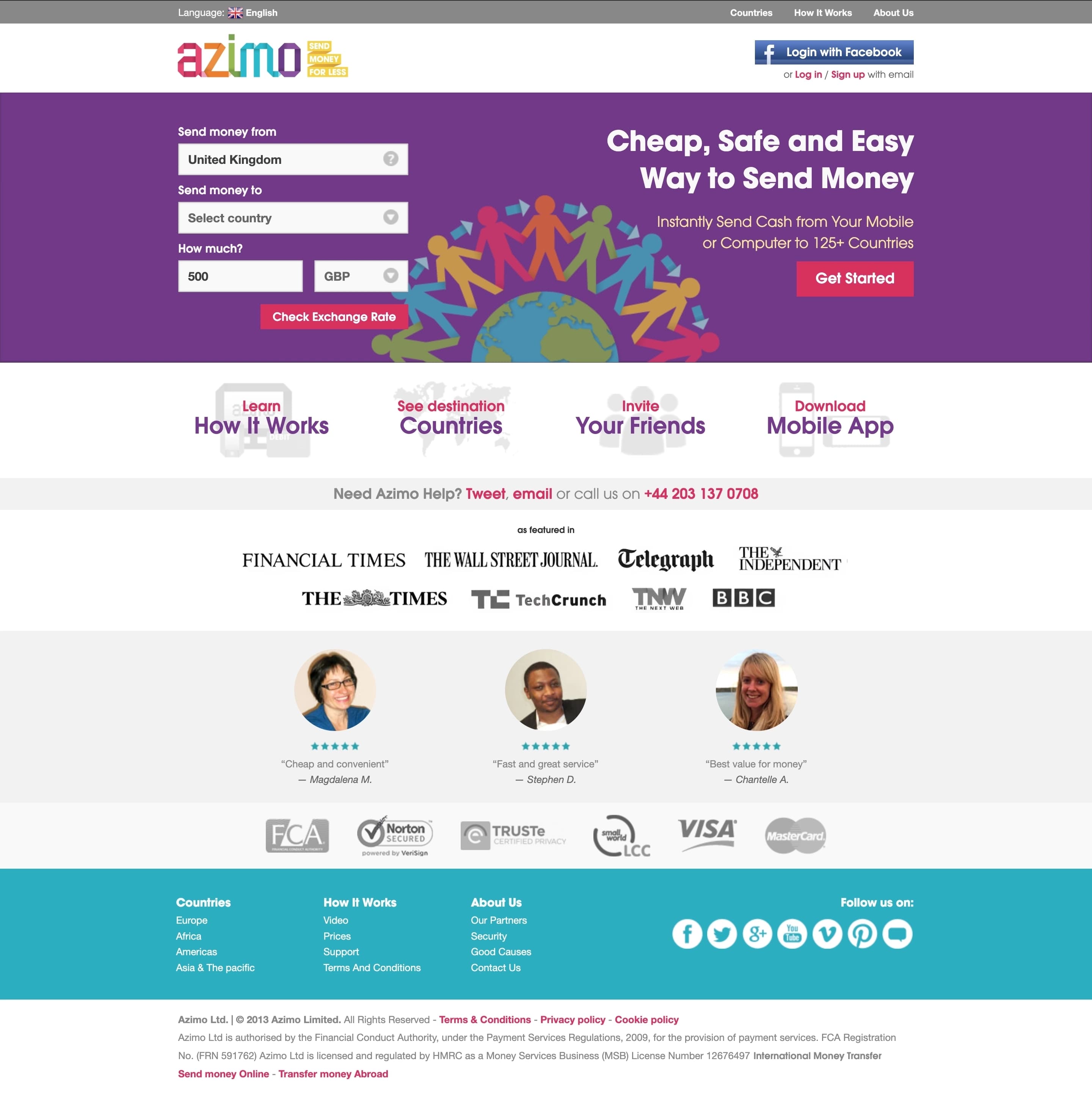

Azimo was a London‑based fintech money transfer service founded in 2012 to make cross‑border remittances and payments faster, cheaper, and easier. In its early stage, the product needed a clear, trustworthy experience that could scale as the company grew and explored innovative social distribution, including sending money via Facebook (launched in 2013). The remittance market was projected to reach $707B by 2016 (World Bank), and winning on usability was critical to growth in the fintech payments space.

In 2022, Azimo was acquired by Papaya Global to power global workforce payments and payroll. The acquisition reflected the strength of Azimo’s cross‑border payout network and product execution.

What we did

- Fintech

- Payments

- Cross‑border Payments

- Remittances

- User Experience

- Product Management

- Conversion Optimization

- Interface Design

- Front‑end Development

- Responsive Design

- A/B Testing

- Facebook Integration

Approach

We were brought in early to lead user experience (UX) and front‑end delivery for a new fintech money transfer platform. Our approach combined hands‑on product leadership with rapid experimentation to unlock conversion and trust at scale.

- Lead the product experience.

End‑to‑end ownership of UX – research, information architecture, onboarding flows, and interface design – paired with front‑end implementation and day‑to‑day delivery.

- Grow through experimentation.

Continuous usability studies and A/B tests guided decisions. We set goals, monitored key KPIs, and iterated quickly to reduce friction and increase trust.

- Differentiate with social & mobile.

Designed an intuitive Facebook integration and pushed mobile‑first, responsive patterns – helping Azimo stand out while preserving brand clarity.

Results and impact

Focusing on onboarding, registration, and early lifecycle messaging, we ran a series of experiments that simplified decision points, removed friction on mobile, and clarified copy.

- All visits conversion (5.58% vs 1.80%)

- +210.39%

- New users conversion (3.32% vs 0.90%)

- +267.07%

- Mobile conversion (2.50% vs 0.09%)

- +2,662.12%

Sending money should be as easy as adding a friend on Facebook.

Founder of Azimo

Making social money transfers easy, removing friction – registration that unlocked growth

Before, Facebook sign‑in tightly coupled identity to a social profile. Disconnecting Facebook broke account access, and sender/recipient roles were rigid – creating dead‑ends and avoidable support load. We redesigned registration to be account‑first with optional oAuth linking and flexible roles.

- Old.

FB connect/disconnect could orphan accounts; sender/recipient were separate, non‑swappable roles; multiple entry points created confusion and abandonment.

- New.

Single, clear registration; social login is optional and linkable/unlinkable without risk; one account with swappable sender/recipient capabilities to support future use cases.

High‑level mapping of the registration flow from brittle, FB‑dependent pathways to a simple account‑first design with optional social linking and unified user roles.